We hope you love the products we recommend! Just so you know, Trendy Mami may collect a share of sales or other compensations from the links on this page.

–

Sponsored by Cash App

When it comes to teaching money management, the best place to start is with one of the best debit cards for teens. Cash App makes that easier than ever with a banking experience designed specifically for users ages 13 to 17. With robust parental oversight, no surprise fees, and features that support smart financial habits, it’s no wonder that Cash App is becoming one of the top debit cards for teens in the United States.

From customizable debit cards to real-time notifications and savings tools, Cash App Families provides the structure teens need to build healthy money habits. It combines the trusted security of one of the most popular financial apps with thoughtful features for guardians, making it an obvious choice among the top debit cards for teens today.

Why Cash App Is a Top Pick for Family-Friendly Banking

When it comes to debit cards for teens, Cash App stands out as a top choice for family-friendly banking. Designed with both teens and guardians in mind, Cash App Families offers an experience that balances independence with oversight. Teens get access to a fully functional debit card, peer-to-peer payments, savings tools, and even direct deposit for part-time jobs, all within safe, customizable settings controlled by parents.

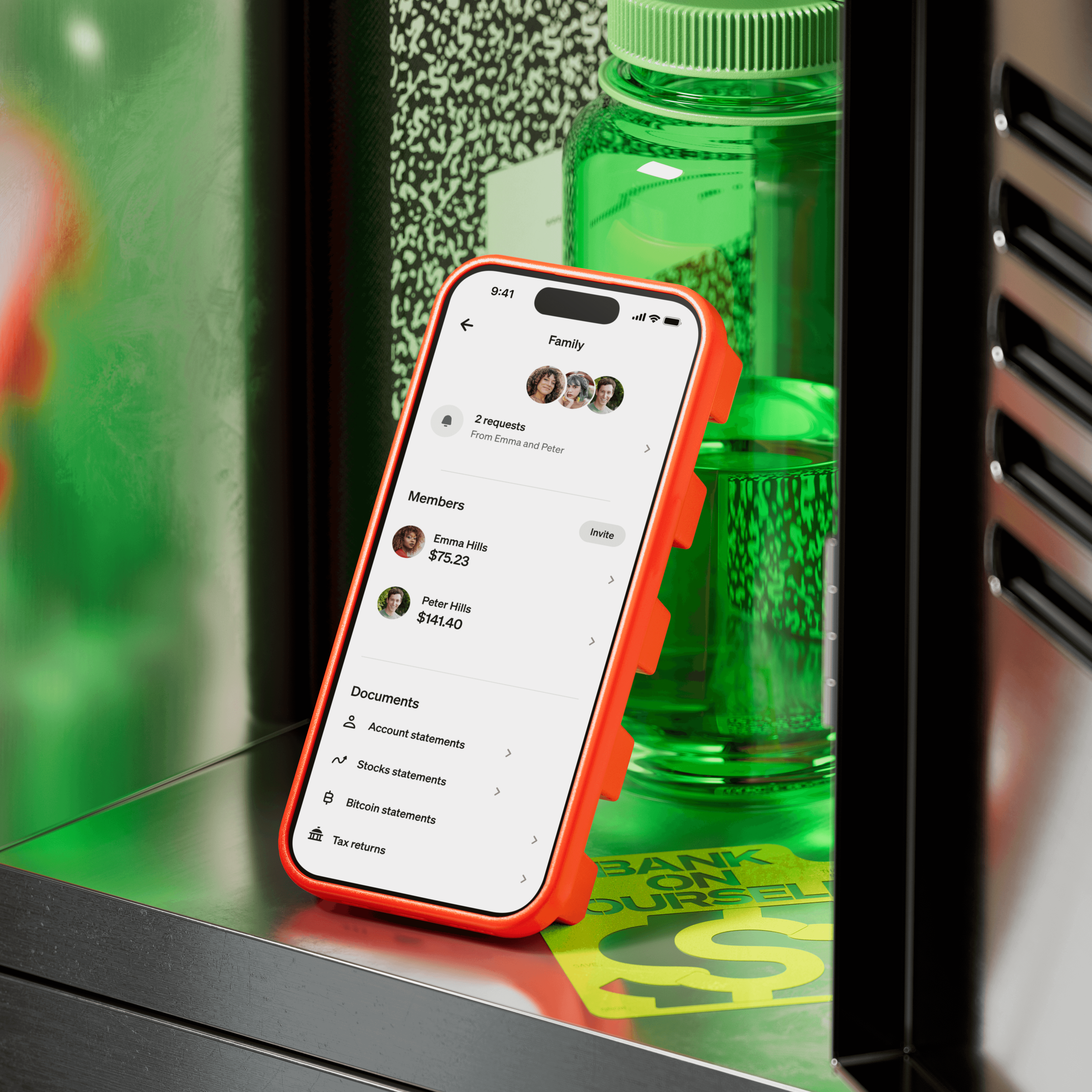

What makes Cash App unique among debit cards for teens is the level of transparency and control it gives guardians. You can monitor spending in real time, approve features like the Cash App Card or sending money to friends, and block contacts or payment categories that raise concerns. This level of oversight ensures that teens can gain financial independence while staying protected, a key reason why Cash App is becoming a go-to for families seeking responsible, flexible, and secure debit cards for teens.

The best debit cards for teens go beyond basic spending and actually teach real-world money skills. Cash App gives teens access to intuitive tools that make budgeting and saving simple and fun. Teens can set savings goals, schedule recurring deposits like allowance, and track progress toward financial milestones. It also offers seamless peer-to-peer payments, which makes it easy for teens to manage side hustle income, birthday gifts, or allowances from parents. With a customizable card and built-in financial tools, Cash App empowers teens to make smart money decisions. It’s not just one of the top debit cards for teens, it’s also a stepping stone toward lifelong financial confidence.

Full Control for Guardians with Real-Time Oversight

When looking for the best debit cards for teens, parental oversight is a must. With Cash App, guardians get a powerful suite of tools to monitor and manage how their teen uses the platform. You’ll receive real-time notifications whenever your teen makes a payment or purchase. If they try to send money to a new contact, you’re instantly alerted.

Cash App also gives you full visibility into your teen’s account activity. From sending and spending to savings and deposits, every action can be monitored through the parent’s own Cash App. Features like blocking certain categories and contacts help provide extra peace of mind, making this one of the safest debit cards for teens available today.

What to Look for in Debit Cards for Teens

Choosing the debit cards for teens for your child starts with understanding what features matter most. When evaluating debit cards for teens, parents should prioritize safety, transparency, and ease of use. Look for cards that offer real-time alerts, spending controls, and simple interfaces that teens can navigate with confidence.

Another key factor to consider with debit cards for teens is the fee structure. Some cards come with monthly charges, hidden fees, or minimum balance requirements. Others, like Cash App Families, remove those barriers entirely while still offering customizable controls and strong security features. The right card should support financial learning without unnecessary costs or confusion.

Cash App stands out among the top debit cards for teens thanks to its industry-leading security features. Teen accounts are set up with default protections that limit visibility, prevent risky payments, and offer enhanced fraud detection. Strangers cannot find your teen in search, and the app automatically blocks suspicious transactions or spending categories.

With 24/7 fraud monitoring, advanced encryption, and the ability to instantly lock a card, Cash App helps keep teens safe as they learn how to manage money. These protections, combined with parental controls, create a highly secure environment. When it comes to debit cards for teens, few options match the level of safety Cash App provides.

How Debit Cards for Teens Build Financial Responsibility

Giving teens access to a debit card is more than a convenience—it is a powerful teaching tool. With debit cards for teens, young users begin to understand the impact of their spending, the importance of saving, and the value of making informed financial choices. Each purchase becomes an opportunity to learn, reflect, and improve money habits over time.

Using debit cards for teens helps bridge the gap between abstract financial lessons and real-world experience. Teens get to practice budgeting, managing income from part-time jobs, and setting aside money for things they care about. These experiences lay the foundation for future financial success while keeping parents involved in a meaningful and supportive way.

Common Mistakes to Avoid When Introducing Debit Cards for Teens

While debit cards for teens are a smart tool for learning about money, they work best when paired with thoughtful guidance. One common mistake parents make is skipping the conversation about limits and expectations. Before activating the card, talk to your teen about what the card can be used for, how to track spending, and what responsible money use looks like. Another pitfall to avoid is not using the built-in tools that come with many debit cards for teens.

Features like spending alerts, contact approvals, and savings goals are there to help teens stay on track and give sponsors peace of mind. Taking the time to explore and set up these features can make the experience more effective and rewarding for everyone involved.

How to Get Started with Cash App for Teens

Getting started with one of the top debit cards for teens is quick and easy. Parents or guardians simply sponsor their teen’s Cash App account from their own app. Once set up, you can manage permissions, track usage, and approve features like peer-to-peer payments, savings tools, and the customizable Cash App Card.

Because there are no monthly fees, no minimum balance, and no hidden costs, Cash App offers a hassle-free way to introduce your teen to smart financial habits. Whether they are earning from a part-time job or saving up for something special, Cash App makes it simple to support their journey. Among all the debit cards for teens, this one is designed to grow with your family’s needs.

Managing Debit Cards for Teens With Confidence

Whether you’re managing allowance, helping your teen with setting savings goals, getting your kid set up for college, helping them make a little extra cash, or tracking purchases, Cash App is a powerful tool that makes financial learning safe and easy. Its flexibility and transparency are key reasons it ranks high among the top debit cards for teens, especially for families who value security and control.

With millions of users already trusting the platform, Cash App offers a clear path for helping young users become confident with their finances. If you’re looking for one of the top debit cards for teens that blends independence with accountability, Cash App delivers on all fronts. Sponsor your teen on Cash App today!

Disclosures

*Cash App is a financial services platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms and Conditions. Direct Deposit provided by Cash App, a Block, Inc. brand. To view the eligibility requirements for sponsoring a teen, please visit the Sponsored Accounts section of the Cash App Terms of Service.